cat stock dividend growth rate

1 Year Dividend Growth. Dividend growth rate g implied by PRAT model.

3 Powerhouse Passive Income Stocks To Buy This Summer The Globe And Mail

Caterpillars next quarterly dividend payment of 120 per share will be made to shareholders on Friday August 19 2022.

. Caterpillar has a dividend yield of 193 and paid 444 per share in the past year. Dividends are adjusted for the 2005 2-for-1 stock split and. Caterpillar stock has fallen 21 compared with the industrys decline.

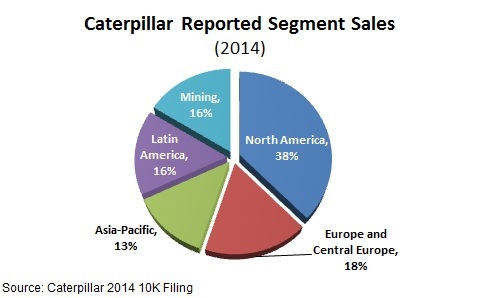

Cat Stock Dividend Growth Rate - Cats business is highly dependent on global economic conditions. 780 As of Mar. Caterpillar has increased its dividend 4.

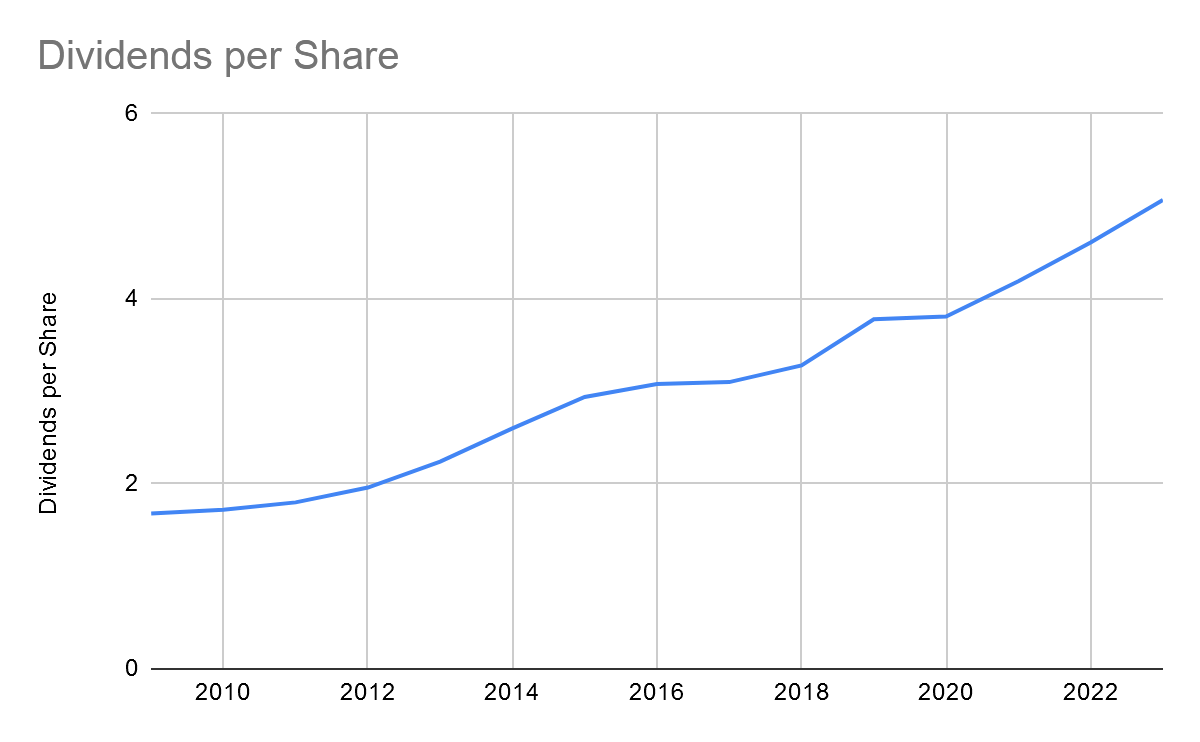

Caterpillar annualquarterly common stock dividends paid history and growth rate from 2010 to 2022. CAT dividend growth summary. The Zacks Consensus Estimate for 2022 is 1230 per share which represents a.

Selected Financial Data. In terms of dividend growth the companys current annualized dividend of 444 is up 37 from last year. Caterpillars Dividends per Share for the three months ended in Mar.

Over the last 5 years Caterpillar has increased its dividend 4 times on a year-over-year. Because the method used is to tally all ex-dates within. 3 5 10 year growth rate CAGR and dividend growth rate.

Caterpillars current payout ratio is 56 meaning it paid out 56 of its trailing 12-month EPS as dividendEarnings growth looks solid for CAT for this fiscal year. The dividend growth rate dgr is the percentage growth rate of a companys stock dividend achieved during a certain period of time. Does Caterpillar CAT have what it takes.

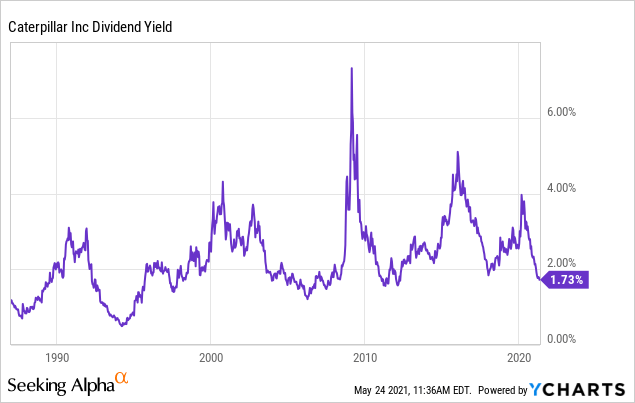

Rates are rising is. Learn more about dividend stocks including information about important dividend dates the advantages of dividend stocks dividend yield and much more in our financial education center. Caterpillar has paid higher annual dividends to shareholders for 28 consecutive years and is recognized as a member of the SP 500 Dividend Aristocrat Index.

Average Dec 31 2021 Dec 31 2020 Dec 31 2019 Dec 31 2018 Dec 31 2017. Caterpillar annual total common and preferred stock dividends paid for 2020 were -2243B a 521 increase from 2019. The Zacks Consensus Estimate.

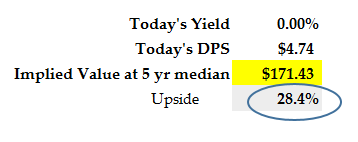

Caterpillar 5-Year Dividend Growth Rate. During the past 12 months Caterpillars average Dividends Per Share Growth Rate was 580 per year. Valuation of Caterpillar common stock using dividend discount model DDM which belongs to discounted cash flow DCF approach of intrinsic stock value estimation.

Start your Free Trial. Each of the CAT dividend growth tables by year are listed below and overall the 1996 to 2021 simple average CAT dividend growth rate 1070 with the worst CAT dividend growth rate. 134 rows Caterpillar has paid a cash dividend every year since the company was formed and has paid a quarterly dividend since 1933.

This means it paid out 46 of its trailing 12-month EPS as dividendLooking at this fiscal year CAT expects solid earnings growth. Finally we come to the growth aspect of the dividend. Each of the CAT dividend growth tables by year are listed below and overall the 1996 to 2021 simple average CAT dividend growth rate 1070 with the worst CAT dividend growth rate over that time being -3065 and the best CAT dividend growth rate being 5116 as detailed below.

Caterpillars current payout ratio is 46. Taking a look at the companys dividend growth its current annualized dividend of 444 is up 78 from last year. The Zacks Consensus.

Over the past 33 months cats revenue has gone down 7384000000. CAT Dividend Growth CAGR. Caterpillar Inc PRAT model.

Dividends are one of the best benefits to being a shareholder but finding a great dividend stock is no easy task. The dividend is paid every three months and the last ex-dividend date was Apr 22 2022. Find the latest dividend history for Caterpillar Inc.

Caterpillar Dividend Information. Common stock cat nasdaq listed. 1 day agoHeadquartered in Deerfield Caterpillar CAT Quick Quote CAT - Free Report is an Industrial Products stock that has seen a price change.

1 year growth rate TTM. The company has a five-year dividend growth rate of 92 and a payout ratio of 41 which is higher than the industry. Be it over a short-term time frame of three years or a longer-term time frame of 10 years CATs dividends have grown at 9-10 CAGR In Q2.

Common stock dividends paid can be defined as the cash outflow for dividends paid on a companys common stock Caterpillar common stock dividends paid for the quarter ending March 31 2022 were -0595B a 587 increase year-over-year. This is Why Caterpillar CAT is a Great Dividend Stock. Year Amount 1Y 3Y 5Y 10Y 20Y 2021 436 583 907 720 913 962 2022e 351 -1950 -386 245.

Right now Caterpillars payout ratio is 46 which means it paid out 46 of its trailing 12-month EPS as dividendEarnings growth looks solid for CAT for this fiscal year. 2022 View and export this data going back to 1929.

Caterpillar S Earnings Look Like And Act Like A Caterpillar Moving Slowly But Steady Fast Graphs

Caterpillar Incorporated High Yield And Even Higher Potential Dividend Ladder

Stock Analysis Caterpillar Inc Cat Just Dividends

Here S Why You Should Hold On To Caterpillar Cat Stock Now

Caterpillar S Expected Dividend Hike And Buybacks Will Push The Stock Higher Nyse Cat Seeking Alpha

Caterpillar Stock A Bargain Or Dead Cat Bounce

Caterpillar Is A Great Dividend Stock And Has Room To Grow Cat R Dividends

Is Caterpillar A Value Stock To Buy Now The Motley Fool

Is Caterpillar Stock A Buy The Motley Fool

Is Caterpillar Stock Worth Buying For 2021 The Motley Fool

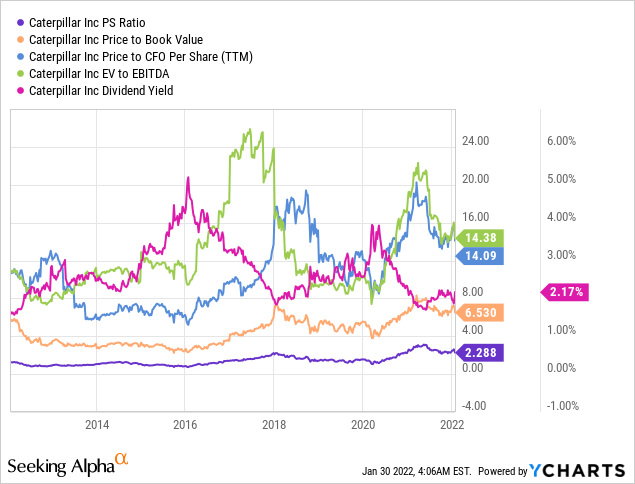

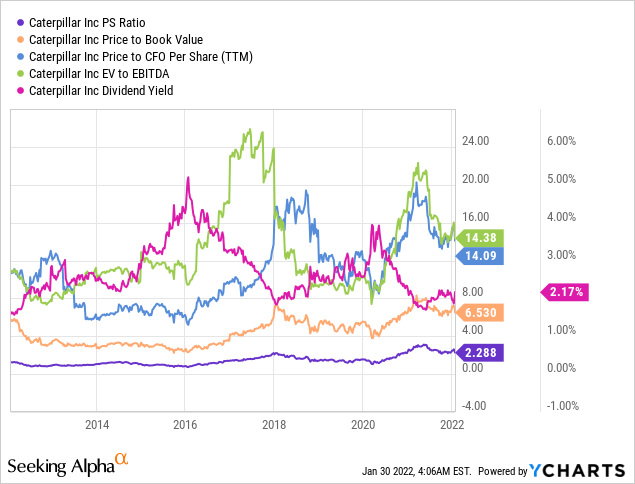

Caterpillar Valuation Decreases The Stock S Attractiveness Nyse Cat Seeking Alpha

3 High Yield Dividend Stocks That Just Went On Sale The Motley Fool

How To Buy And Build A Caterpillar Position Nyse Cat Seeking Alpha

Are Dividend Stocks Dead The Motley Fool

Caterpillar Transforming Itself Into Stable Growth And Earnings Nyse Cat Seeking Alpha

Caterpillar S Expected Dividend Hike And Buybacks Will Push The Stock Higher Nyse Cat Seeking Alpha